Cleva, a Nigerian fintech company focused on creating a banking platform for African individuals and businesses to receive international payments by opening USD accounts, has raised US$1.5 million in pre-seed funding.

The round was led by 1984 Ventures, an early-stage venture capital firm based in San Francisco. Other participants in the round include The Raba Partnership, Byld Ventures, FirstCheck Africa and several angel investors.

Aaron Michael, partner at 1984 Ventures, expressed support for Cleva founders Tolu Alabi and Philip Abel, noting that their product offers Africans a way to deal with the challenges of hyperinflation, which he described as A huge opportunity. “Given their experience building banking products at Stripe and building powerful platforms at AWS, the team is uniquely qualified to solve this problem. The impressive early growth is a testament to the team’s unique ability to execute in Africa and the United States,” he added road.

Y Combinator also participated in Cleva’s pre-seed round as fintech companies begin participating in the accelerator’s Winter 2024 batch this month. The renowned accelerator has previously supported African startups, such as Gray Finance and Elevate (formerly Bloom), helping freelance and remote workers on the continent open U.S. bank accounts to receive payments, save and currency exchange.

In an interview with TechCrunch, CEO Alabi explained the rationale for launching the platform in August despite a competitive landscape with other platforms such as Techstars-backed Geegpay and Payday.

First, she highlighted the ongoing challenges Africans still face in accepting international payments for their skills and products, a pain point the two founders discovered through second-hand experience and extensive research. They estimate that a market for facilitating payments for remote and freelance workers in Africa would represent an $18 billion opportunity.

Image Source: seva

Another key factor is founder-market fit. Both founders have strong ties to the African market. They were born and raised in Nigeria and moved to the United States on college scholarships, with Abel attending MIT and Alabi then attending Stanford University’s Graduate School of Business. Notably, they gain valuable technical and product experience from working at large tech companies like Amazon, Stripe, AWS, and Twilio.

“Then there’s the market opportunity,” Alabi said in the interview. “The problem we’re trying to solve is enabling people to receive international payments, and it’s not a Nigerian problem, it’s not an African problem. It’s a global problem; people in Latin America, Asia and even Canada need it because of their jobs and dollars for our services. We started in Nigeria because we understand the market and it’s a big market. But we feel that because of our background we are well-positioned to solve this problem globally.”

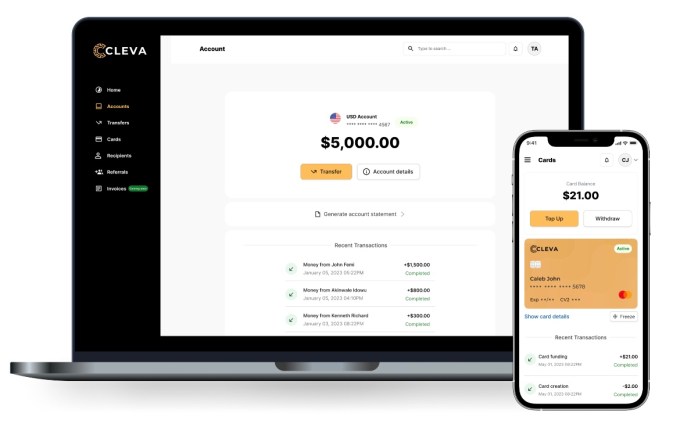

Initially launching its service to Nigerians, Cleva allows users to open USD accounts, requiring a Bank Verification Number (BVN) and government-issued ID upon onboarding. (It’s worth highlighting that while Cleva exclusively offers USD accounts, other players also offer accounts in GBP and EUR.) In the four months since launch, the Delaware- and Lagos-based fintech has It has helped “thousands” of people open U.S. accounts, processing more than $1 million in payments each month while revenue grew 100% month-on-month, its CEO said.

As Alabi highlights, fintechs stand out from the competition in two key areas: customer experience and business model. “We firmly believe that only by constantly going above and beyond can we give our customers a great experience. This is the feedback we get from our customers. They know that when they send us an email or contact our customer support, they don’t need a word or two. Weeks,” she commented.

Meanwhile, the YC-backed startup generates revenue by allowing users to convert funds (in US dollar accounts) into local currency (currently naira), while also charging a 0.9% fee on deposits made into customers’ US dollar accounts. It’s worth noting that Cleva’s fees are capped at $20, unlike competitors, which typically charge an uncapped fee of 1% regardless of the amount received.

Looking ahead, Cleva is developing several upcoming products to diversify its revenue streams, including U.S. dollar cards and U.S. asset savings, CTO Abel said in an interview. Additionally, Cleva must grapple with common challenges faced by similar fintechs, such as finding the right banking partners and talent, and will soon target Africans in the diaspora. To that end, according to its website, other upcoming products include allowing users to create professional invoices and send USD globally, Enter the highly competitive remittance category, where platforms such as Flutterwave’s Send, Chipper Cash, Lemfi and Afriex are all active.

The overall addressable market for fintech companies focused on freelance workers and Africans abroad is expected to continue to grow. This trend is driven by a globalized world, with more young Africans upskilling and exporting their talents to meet the growing demand for skilled workers. “In the long term, we are open to Cleva moving from a pure product service to a platform that publishes APIs that can do many other things and help us distribute services in other African countries or around the world,” Abel said. More details on Cleva’s future roadmap.