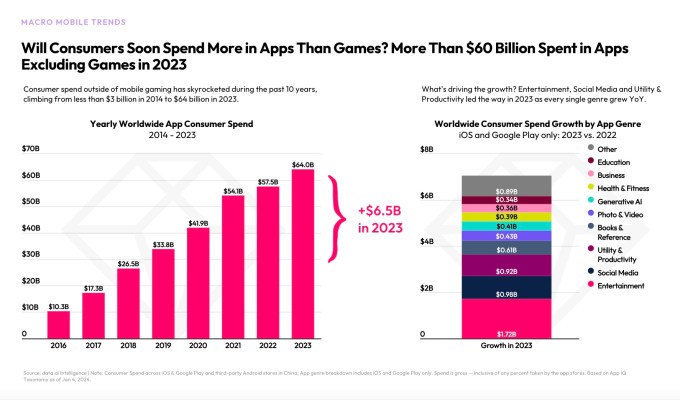

After the app economy first slowed in 2022, things accelerated again last year. According to the annual “State of Action” report released today by app intelligence provider data.ai, consumer spending on apps will increase slightly by 3% in 2023 from last year, with the App Store, Google Play and the third largest app Stores reached $171 billion. -Chiana’s Party Android App Store. A growing portion of total consumer spending comes from apps rather than mobile games, thanks in part to TikTok’s success. However, app downloads last year were flat at 257 billion, an increase of only about 1% year-on-year.

In 2022, the continued growth of the app economy finally hit a snag in the post-COVID recession as consumer spending normalized and a sluggish economy caused more people to tighten their wallets. Back-of-the-envelope calculations even suggest that consumer spending on Apple’s App Store may have slowed as well, but it’s impossible to come up with an exact number because Apple’s deal cut is no longer a flat 30% across the board.

Data.ai found that last year, things were moving in a positive direction again.

In 2023, consumer spending on non-game apps will increase by 11% annually, reaching $64 billion. Social apps and the creator economy have fueled this growth, with TikTok playing a leading role. Last year, for example, the short-form video app hit a new milestone of surpassing $10 billion in lifetime spending, becoming the first non-gaming app to do so. This year, data.ai predicts that consumer monetization in social applications will grow 150%, reaching $1.3 billion.

Image Source: data.ai

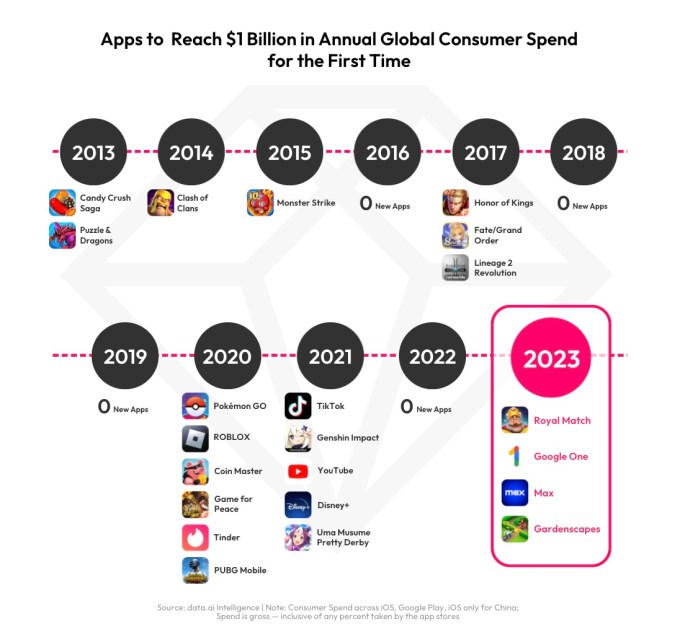

Elsewhere, more than 1,500 apps and games will generate more than $10 million in annual revenue by 2023, while There are 219 companies with more than 100 million US dollars, and 13 companies with more than 1 billion US dollars. This year, four new apps hit $1 billion in revenue, including Royal Match, Google One, Max and Gardenscapes.

Image Source: data.ai

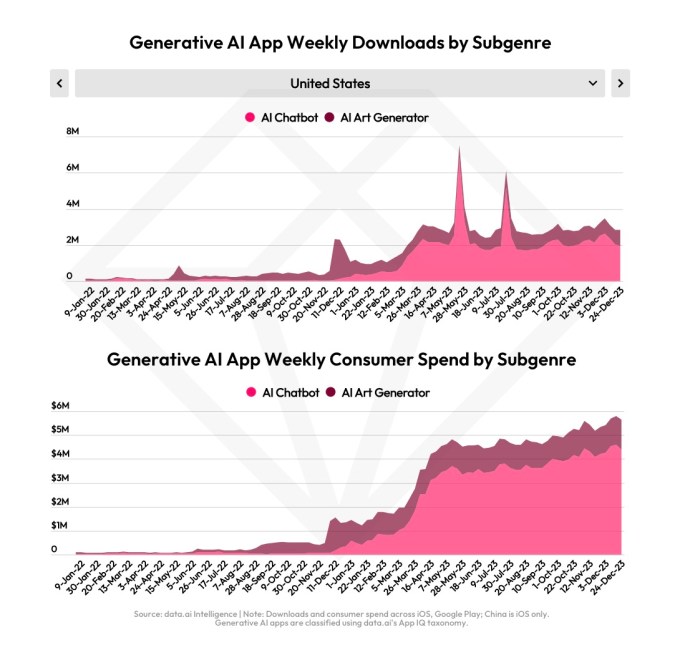

The company also noted that advances in generative artificial intelligence helped drive consumer spending last year. The genAI app market expanded seven times, bringing new consumer experiences such as AI chatbots and AI art generators. In terms of consumer spending, the top apps include ChatGPT, Ask AI, and Open Chat. Data.ai notes that the popularity of AI applications is “quite global,” but the genre doesn’t rank among the breakout genres in China, Japan, Saudi Arabia, and Turkey.

Image Source: data.ai

data.ai found that in response to consumer demand, more than 4,000 apps added the word “chatbot” to their app descriptions, and more than 3,500 apps added “gpt.” Additionally, 2,500 apps launching in 2023 have “chatbot” in their descriptions — the company says that’s nearly double the number of apps launched in the previous four years combined.

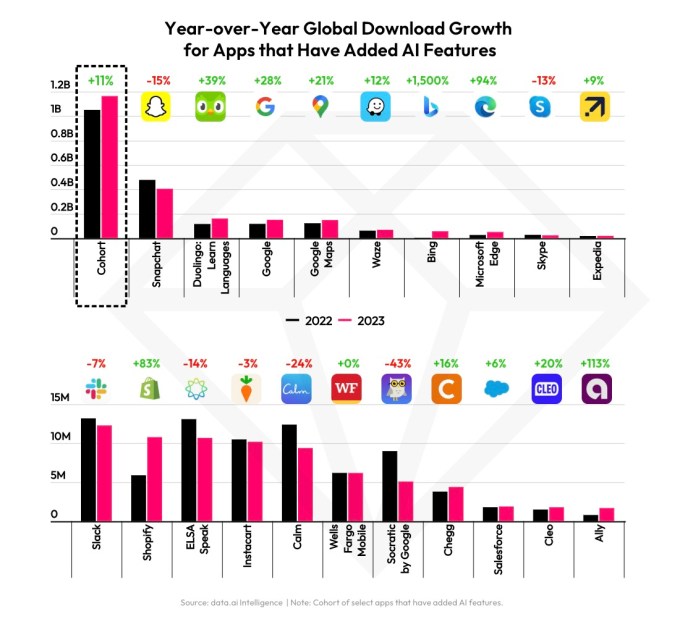

In addition to the AI applications themselves, other applications employing AI features will also perform well in 2023.

data.ai found that downloads of 20 apps that added such features increased by 11% year-on-year. Thirteen out of 20 (65%) also experienced positive growth.

Image Source: data.ai

The full report also delves into other metrics of app ecosystem health, including installs, time spent, ad spend, game-specific details, and more.

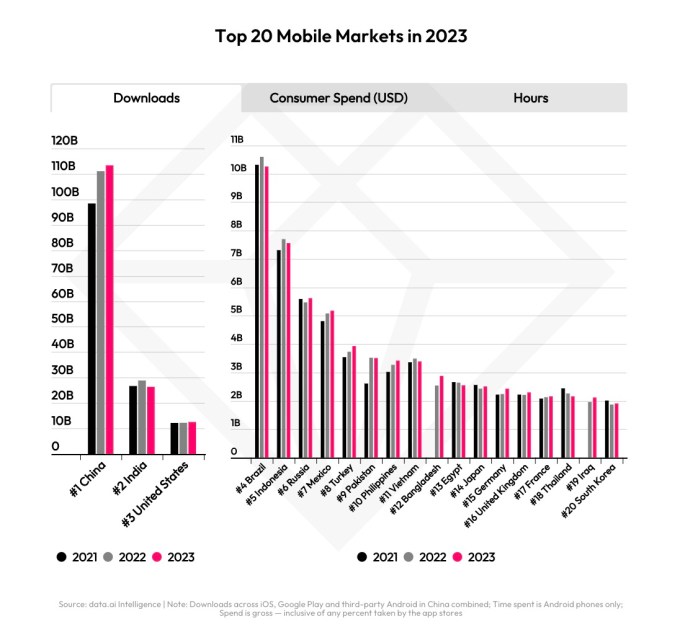

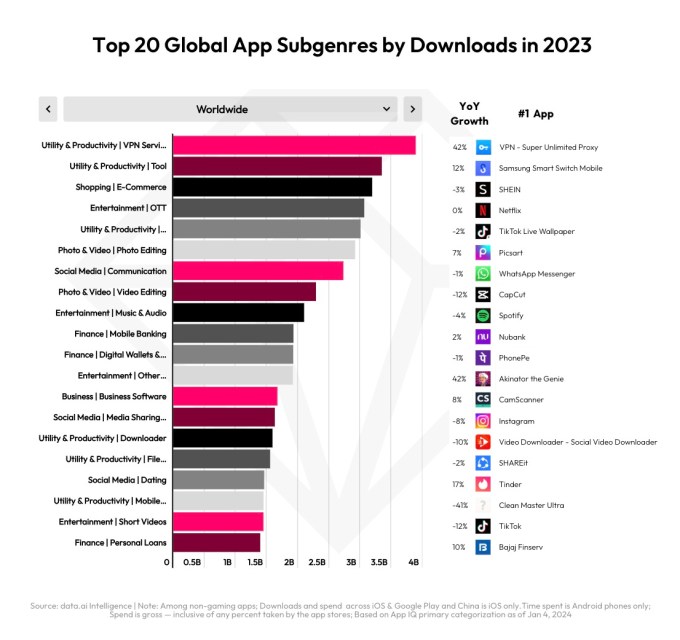

Last year, China led India (No. 2) and the U.S. (No. 3) in app installs, with Bangladesh emerging as the fastest-growing market. Subtypes of apps include utilities, productivity apps, shopping, entertainment, photos and videos, and more.

Image Source: data.ai

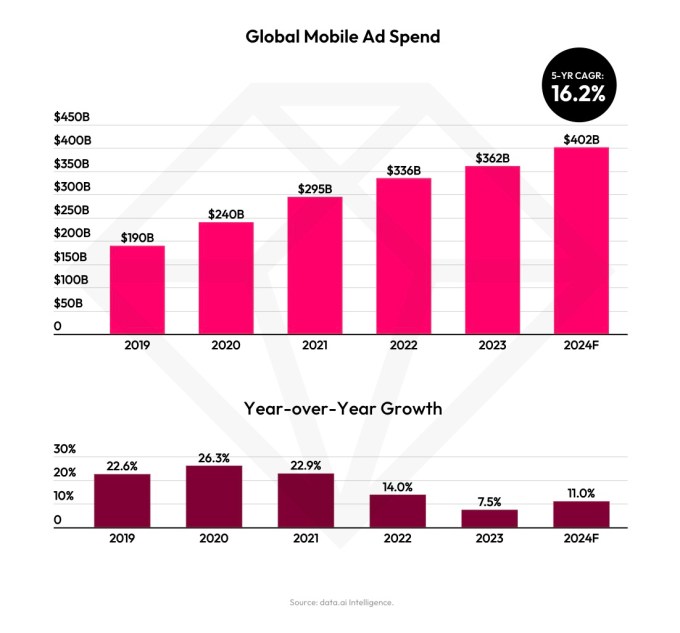

Data.ai also reported that advertising spending reached a peak of US$5.1 trillion, an annual increase of 6%, and mobile advertising spending this year is expected to reach US$362 billion, an increase of 8%. data.ai estimates that as advertising spending rebounds from the slowdown in 2023, it is expected to grow significantly by 16.2% in 2024, reaching $402 billion.

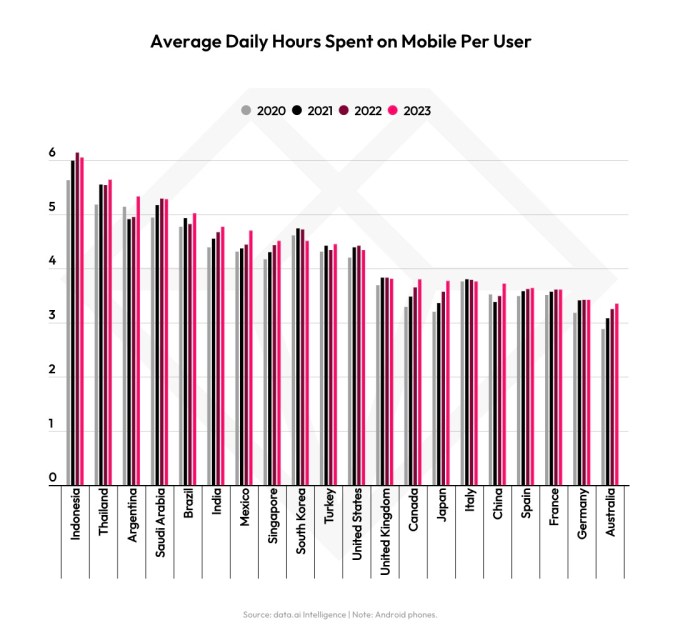

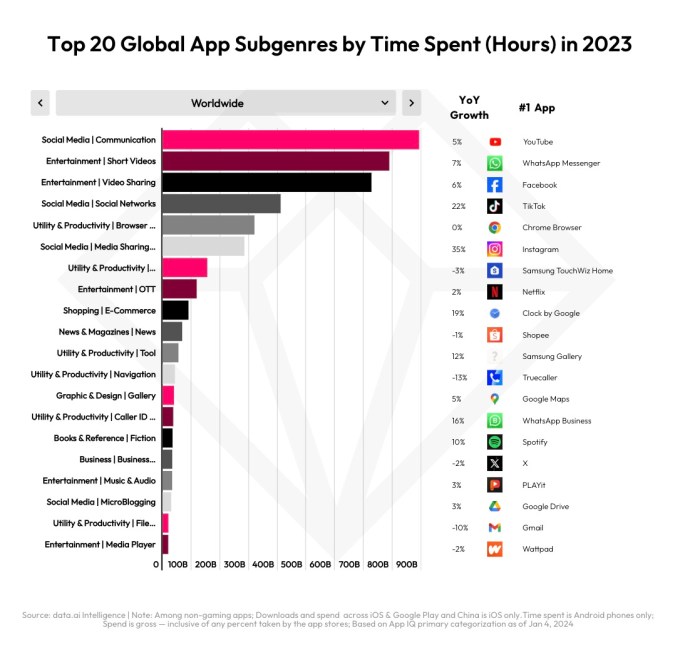

At the same time, in 10 major markets, the average time spent by each user on mobile devices per day increased by 6% compared with 2022, reaching more than 5 hours. Here, apps like YouTube, WhatsApp, Facebook, TikTok, Chrome, Instagram, Netflix etc. help increase time spent.

Image Source: data.ai

Image Source: data.ai

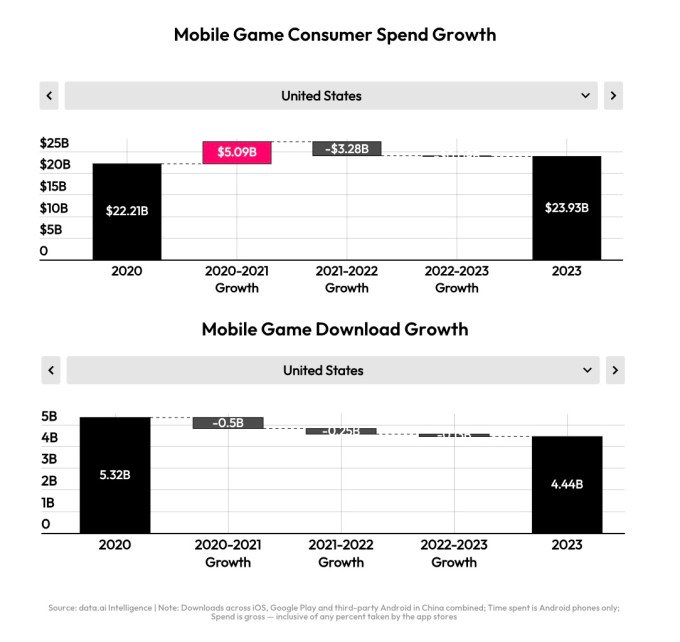

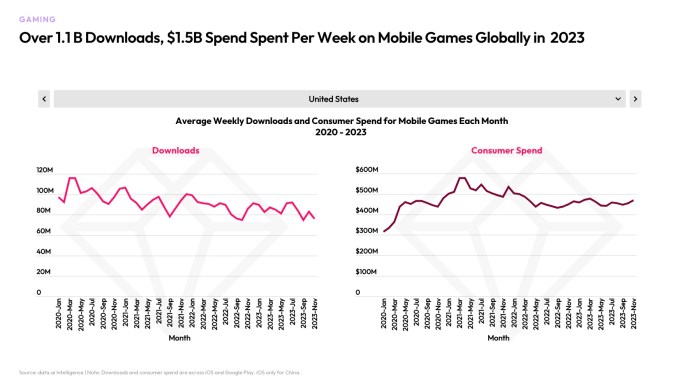

However, mobile games performed less well in 2023, with spending down 2% from the same period last year to $107 billion. Game downloads were roughly in line with previous years, accounting for 88 billion of the 257 billion total downloads. Popular game genres include hypercasual, simulation, and action. Breakout games this year include Monopoly GO and EA Sports FC Mobile Soccer. Genshin Impact surpasses $4 billion in lifetime spend, another milestone. Games like Block Blast Adventure Master and Attack Hole drove downloads, and games like Avatar Life were unexpectedly popular. Gacha Life 2 and Eggy Party have also seen huge growth in downloads and usage.

Image Source: data.ai

Image Source: data.ai

Other trends for 2023 are that Chinese shopping apps such as Temu and Shein grew by 140% after entering Western markets, while usage time of social and entertainment apps increased by 12% to 3 trillion hours. The latter’s spending also rose 10% to $29 billion.

Post-pandemic trends have also continued, with travel app downloads increasing by 13%, driven by travel services (26%), travel bookings (80%) and flight bookings (43%). Likewise, ticketing apps grew 31%, up 66% from pre-pandemic levels, thanks to major Taylor Swift and Beyonce concerts.

The full report breaks down top apps and games by country by metrics like installs, spend, and time of day, with deep dives into finance, retail, video streaming, social, food & drink, travel, health & fitness, sports, and more field.

Globally, the number one app by installs and spend is TikTok, but Facebook remains number one by time spent. The top games are Subway Surfers (downloads), Candy Crush Saga (consumption), and Roblox (monthly active users).

Image Source: data.ai

Image Source: data.ai

3 Comments

Pingback: App economy recovers in 2023, consumer spending hits $171B, but downloads flat – Tech Empire Solutions

Pingback: App economy recovers in 2023, consumer spending hits $171B, but downloads flat – Paxton Willson

Pingback: App economy recovers in 2023, consumer spending hits $171B, but downloads flat – Mary Ashley