When it comes to getting paid for your hard work, the faster you get your money, the better.

However, sometimes it can be a hassle to go to the bank or use a mobile banking app to cash or deposit a check every time you receive a payment. If you’re looking for a more convenient method, direct deposit is the answer.

direct deposit, Services typically provided by payroll agencies, Simplify your payroll process, Get your hard-earned money electronically deposited directly into your bank account. Let’s take a closer look at how direct deposit works and how it can benefit you.

What is direct deposit?

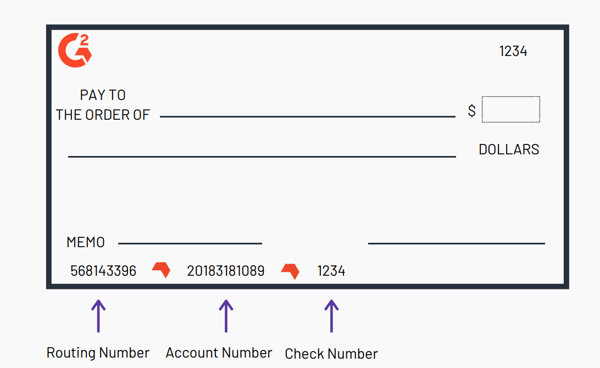

When you start a new job, your employer will give you a direct deposit form. You’ll need to fill out this form, which includes your bank account number, routing number, account type (usually a checking account), bank name and address, and the canceled check.

How to set up direct deposit:

- Fill in your bank routing number

- Fill in your bank account number

- Specify account type

- Fill in the bank name and address

- including canceled checks

Your routing number is a nine-digit number that can be found in the lower left corner of the front of your check. Your bank account number is to the right of that, also in the lower left corner. Your checking or savings account will be the account type you choose.

Some direct deposit orders may also ask for your Social Security number and home address, so make sure you have this information on hand. Once you have completely filled out the direct deposit form, give it to your employer.

How does direct deposit work?

Direct deposit is an online payment process that eliminates the need for a physical check. It provides a secure and convenient way to deposit your paycheck or other recurring payments directly into your checking or savings account. Here’s a detailed explanation of how it works:

1. Set up direct deposit:

- You will provide your employer (or other payer) with your bank account information. This usually includes your routing number and account number, which can be found on your checking or bank’s online portal.

- Some employers may offer direct deposit registration online, while others may require a paper form.

2. Electronic transfer:

- Before payday, your employer initiates the direct deposit process. They send a secure electronic notification to the bank that includes your banking information and payment amount.

- The notification is transmitted over the Automated Clearing House (ACH) network, a centralized system that facilitates electronic bank transfers in the United States.

- ACH sends the message to your bank.

3. Receipt of funds:

- Your bank is notified and verifies your account information.

- Once everything checks out, your bank will automatically deposit the funds into your designated account on the scheduled date.

- You will usually receive an alert from your bank notifying you of your deposit.

How long does direct deposit take?

Curious when your first direct deposit will be deposited into your account? While setting up direct deposit is a breeze, It may take one or two pay cycles before you see the money reflected in your balance.

This is because, In some cases, Your employer may perform a physical check during the initial transition period to make sure everything is set up correctly.

Once direct deposit is fully activated, The exact time your funds appear depends on your company’s payroll and software. Some businesses make payments every two weeks; While others choose to be paid weekly or have a fixed schedule on the 15th and 30th.

To avoid any surprises, preferably Check with your employer About their payroll administration timeline and when you can expect to receive your first direct deposit.

Benefits of Direct Deposit

Direct deposit offers a win-win situation for both employers and employees. It eliminates the hassle of paper checks and provides secure, The convenient way to manage your finances. That’s it:

For employees:

- Automatic deposit: Say goodbye to waiting for a check to arrive or remembering to deposit a check. Your paycheck will automatically appear in your bank account on payday, Ready to use immediately.

- Inner Peace: Direct deposit eliminates the risk of lost or stolen checks. Your funds are deposited directly into your secure bank account.

- Faster access: Unlike paper checks, which take days to cash, Direct deposit is usually available immediately on payday, Let you get funds faster.

- Simplify record keeping: An electronic record of your paycheck is easily available in your bank statement, Makes budgeting and tax preparation easier.

For employers:

- save costs: Direct deposit eliminates the need to print a check. buy envelopes, and postage, Reduce administrative costs associated with payroll processing.

- Improve efficiency: Automatic deposits streamline the payroll process, Save time and effort compared to processing paper checks.

- Reduce errors: Direct deposit eliminates potential errors associated with writing and distributing physical checks.

- Improve security: There is no risk of lost or stolen checks, Make sure your employees receive their paycheck safely.

Direct is always best

Whether you are receiving or sending payments, Switching to direct deposit can save you time, money, and peace of mind. Setting up direct deposit is easy, both in life and when it comes to deposits, and you’ll see your payments arriving in your bank account in no time. Don’t spend all your money in one place!

Ensure accurate and efficient payroll processing time tracking software.

Free direct deposit form

Whether you are an employer or employee who needs a direct deposit form, you can download the form G2 has for you here!

This article was originally published in 2019..