There are two industries that make a lot of money, but which have traditionally been largely ignored by venture capital — movies and games. This comes as a bit of a surprise to many: Venture capitalists are known for their keen eye for high-growth opportunities, focusing primarily on tech startups, healthcare innovations and the next big thing in digital. But according to Newzoo data, Deadline reported that movie revenue last year was $33.9 billion, and global gaming revenue was $184 billion. Still, the offer to invest in movies brings venture capitalists into a realm far removed from the calculable metrics of SaaS platforms or the relatively predictable risks of biotech.

The development of games and movies is hit and miss, and this unpredictability is rarely considered in traditional venture capital investment papers.

I’ve always been particularly curious about pitch decks in the gaming industry, so I was excited when SuperScale got involved. The company promises to make marketing games easier, and considering great marketing is one of the key differences between good results and wild success, it piqued my curiosity in a most delightful way.

We’re looking for more unique collateral to tear down, so if you’d like to submit your own, here’s how.

Slides in this deck

The company submitted a 22-slide presentation, but “details of clients and client case studies that we did not receive approval for distribution have been redacted,” it said.

- coverslip

- question slides

- Solution Slides

- Macro market size forecast slide

- Market size forecast slide

- Market size slide (2027)

- Target customer slides

- Platform interstitial slideshow

- How slideshow works

- Market segmentation slideshow

- business model slides

- Case Study Slides

- Athletic landscape slide

- Business plan interstitial slides

- 5-year plan summary slide

- Ask for Slides

- Fund Usage Summary Slide

- Abstract slide

- Team slides

- Appendix Interstitial Slides

- Company History Slideshow

- Close/contact slide

3 things to love about SuperScale promotional materials

SuperScale has a very slick looking deck that hits the mark. Twenty-two slides might seem like too many slides (the optimal slide length these days is about 16 slides), but there are some gap slides and appendices in this slideshow that don’t actually count.

Let’s take a look at some of the methods that actually work.

Build your own market

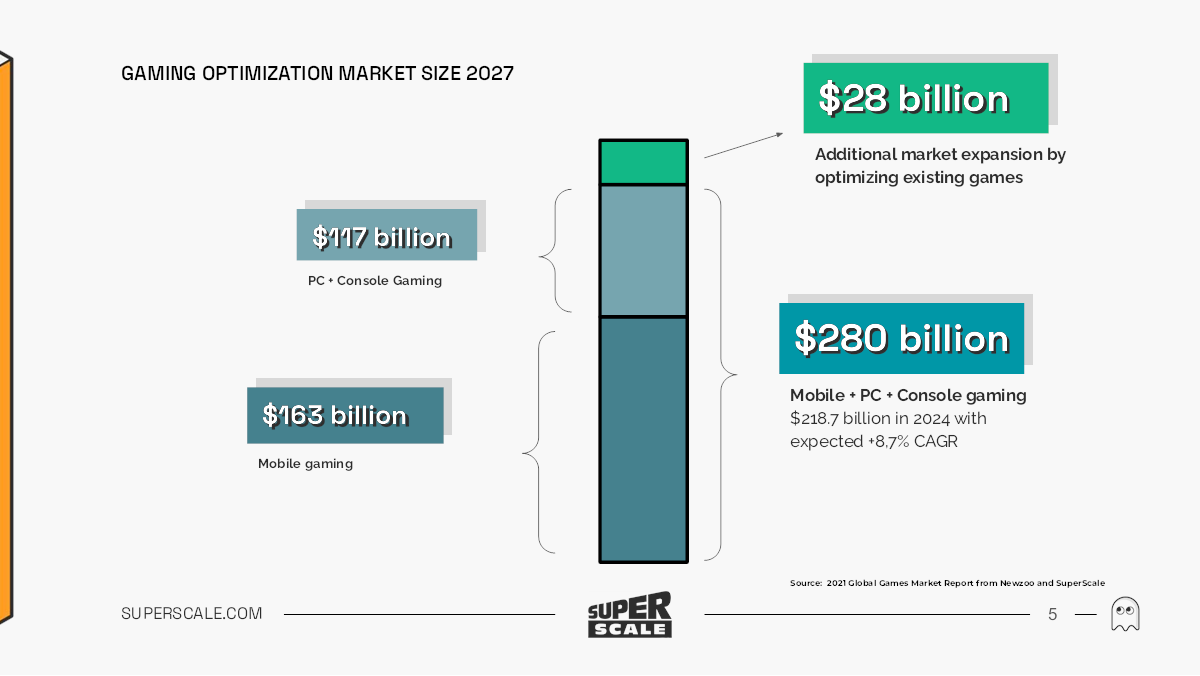

[Slide 5] This will undoubtedly attract the attention of investors. Image Source: Hyperscale

Gaming is a huge market, and investors don’t need to believe that. The question, then, is how to get a piece of this delicious digital pie. SuperScale makes some interesting leaps of faith here: these numbers are projections for 2027, not talking about today’s numbers. But this slide comes early in the slideshow. It would be really interesting if SuperScale could make a strong argument for how it could be part of the machine that makes gaming grow by 10%.

This is bold and brazen storytelling. Of course, the company is now preparing to have to share plans and show receipts, but it’s a great way to generate investor interest immediately.

reborn

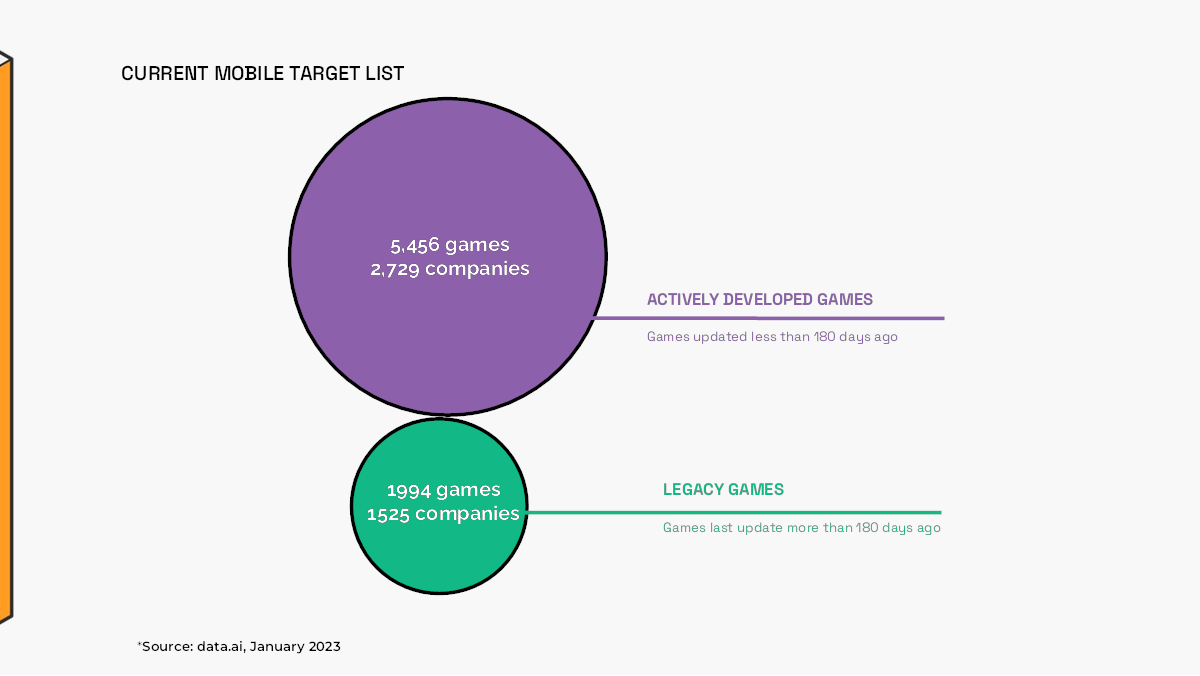

[Slide 7] SuperScale promises to target two markets. Image Source: Very large scale

As a game optimization company, SuperScale has an interesting approach, and this simple slideshow makes a smart promise: What if we could dramatically increase the profitability of our existing games? Part of the purpose of SuperScale mode is to bring these games back to life at a stage in the game’s release cycle where every dollar is essentially a bonus. There’s nothing crazy about this deck, but I could see this being a very powerful selling technique for game studios – if it’s successful in traditional games (which is essentially risk-free) then integrating Wouldn’t it be wise to get up? Is SuperScale also available on new games?

It’s very smart and investors can see that.

This is how you summarize

Besides the design and the almost unreadable text, the content on this slide is great:

[Slide 18] Of course. Image Source: Very large scale

I love a good summary slide. Give investors all the thinking and talking points they need to get them excited about investing. This is a great approach.

Three things SuperScale could improve

Overall, this is one of the best pieces of promotional material I’ve ever seen, but there are a few things that make me go “meh.”

Wait, how big is your team?

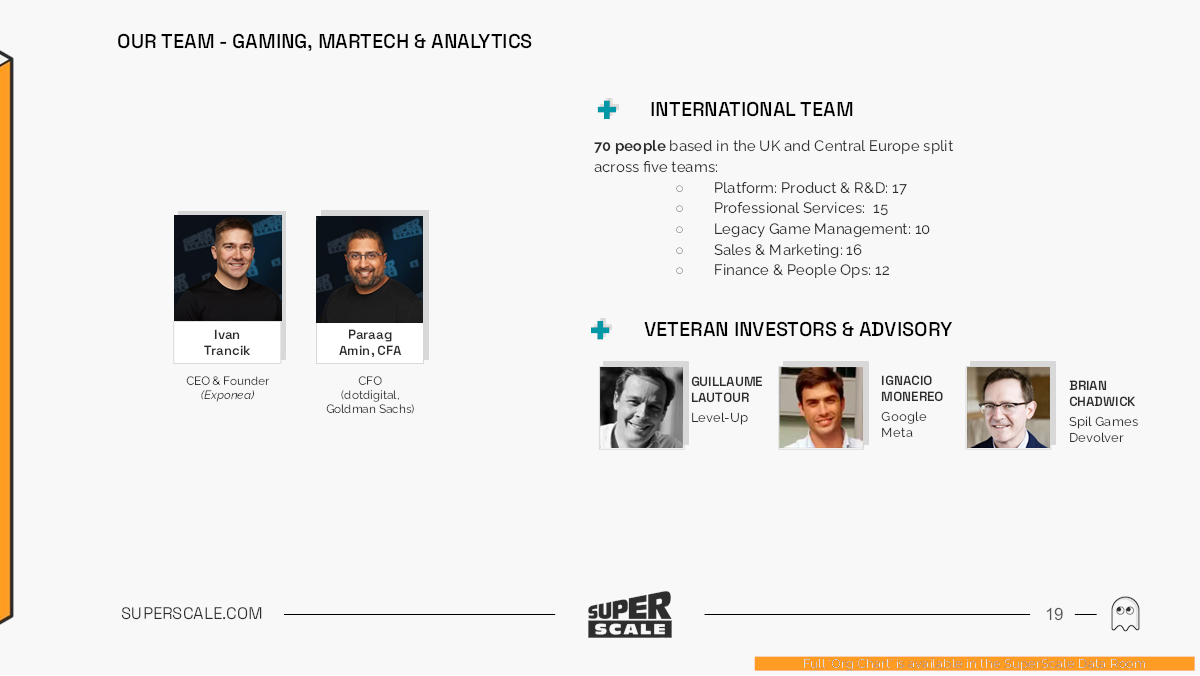

When a company raises around $5 million, I typically expect a team of 10 to 15 people. This team slide is a bit surprising:

[Slide 19] That’s a big team. Image Source: Very large scale

Putting this slide at the end makes me wonder how serious this startup is. If it has five business units and 70+ team members, the rest becomes confusing. There is an inquiry slide, but no reliable use of funds. You can’t sustain a team of 70 people without significant revenue. The company spends a lot of time talking about 2027 and its five-year plan, but completely hides how much money it makes.

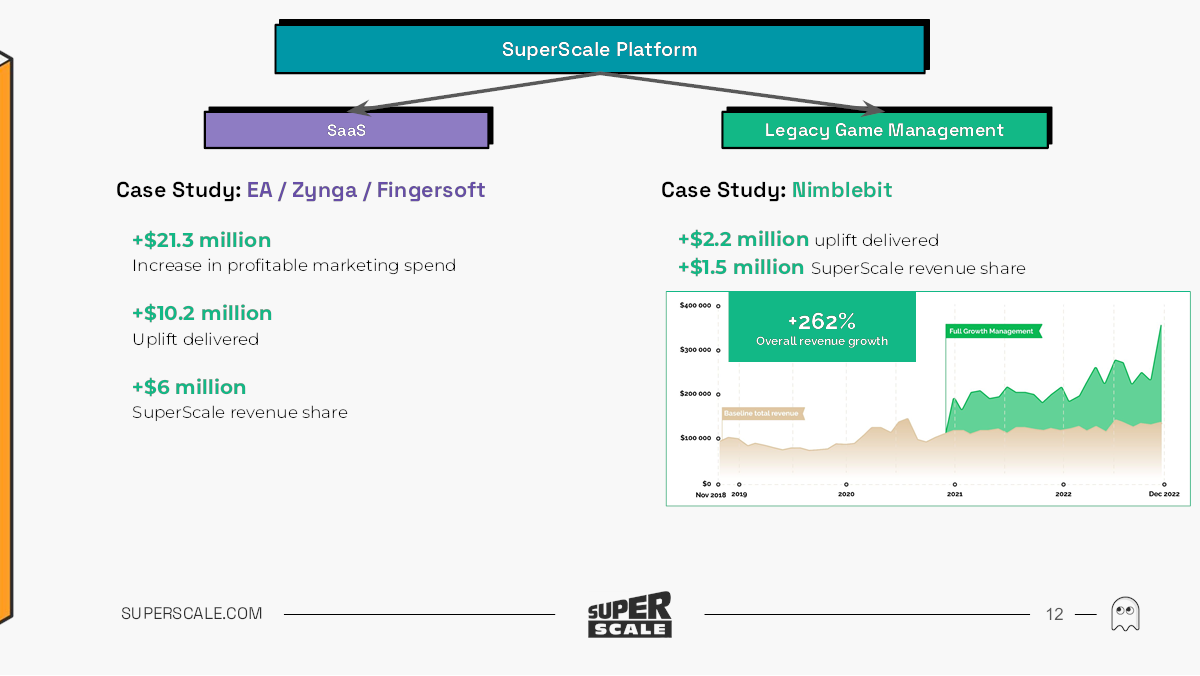

There is some information on earnings, but only in the form of case studies:

[Slide 12] Blink and you’ll miss it, but this slide contains some key business metrics. Image Source: Very large scale

Did you discover it? SuperScale received $6 million from EA, Zynga and Fingersoft. NimbleBit also provided an additional $1.5 million.

That’s impressive, but it’s a bad Way to show that traction. The right traction slide shows these numbers not as totals, but as revenue graphs that show how much and how fast revenue is growing over time.

Why does SuperScale fundraise?

What’s puzzling is why the company raised about $5 million when revenue numbers were normal.

[Slide 16] What? Image Source: Very large scale

This slide makes almost no sense. On Slide 12, the company noted that its case study clients alone generated revenue worth $7.5 million. How many customers are there? we do not know. How much income is there in total? have no idea. What does it plan to do with the money? Well, here’s a slideshow:

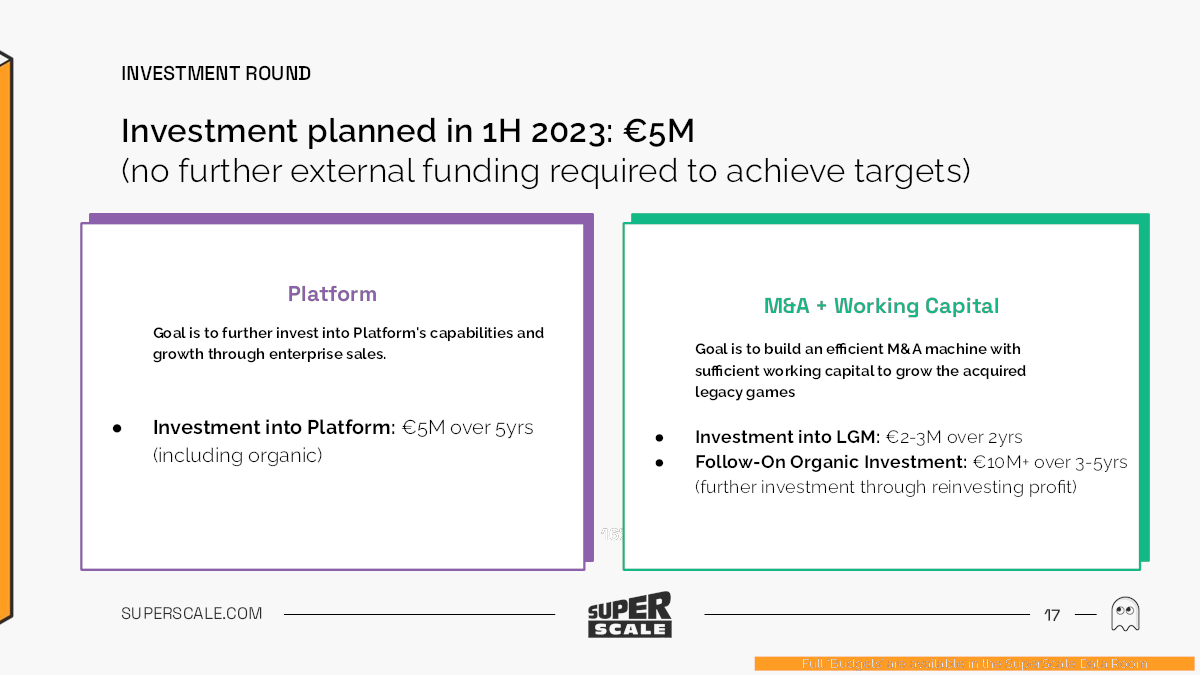

[Slide 17] Raising money for a five-year runway? Image Source: Very large scale

This slide is worthless. The company said it is building an M&A machine, suggesting it is planning to acquire the rights to legacy games and potentially develop them. This is great, but it requires a concrete plan for this.

There’s also an internal contradiction here: It says it needs $5 million to hit its target, but then says it will “invest organically” by reinvesting profits.

In the world of M&A, $5 million is almost nothing, so now I’m curious who the acquisition targets are and how the company assumes these acquisitions will help its bottom line.

Tell a coherent story!

SuperScale seemed like a great investment opportunity when I first read through it, but as I started scratching my head at the deck, it made less and less sense. The company seems to want to acquire other companies (or games?). The company has 70 employees but has raised only $5 million. It doesn’t share its past successes or plan how to find the successes it needs in the future.

Overall, I think a better way to tell this story is to have an end-to-end story and tell it coherently:

- We purchased Game A for B dollars.

- We invested C$C in the game’s growth infrastructure.

- We invested D dollars in marketing the game.

- After investing only $C+D, the game’s revenue increases from $E to $F.

- As you can see, we made $X in profit on this project, and we predicted that the playbook would work for games with this specific profile.

- We want to build a portfolio of 30 games, which is why we raised 30*($B+$C+$C), after which this will become a self-sustainable business with a repeatable playbook and business model .

That The story makes sense to investors.

Complete promotional materials

If you’d like to present your own collateral teardown at TechCrunch, here’s more information!