After the tech investment bonanza of 2020-2021, Europe is suffering huge hangovers. Still, venture capital investment in new European startups has historically increased compared to pre-pandemic levels, reaching $60 billion, according to a new report. However, despite the signs of “green shoots”, the anomaly of the surge in investment during the pandemic contrasts sharply with growth and creates significant headwinds.

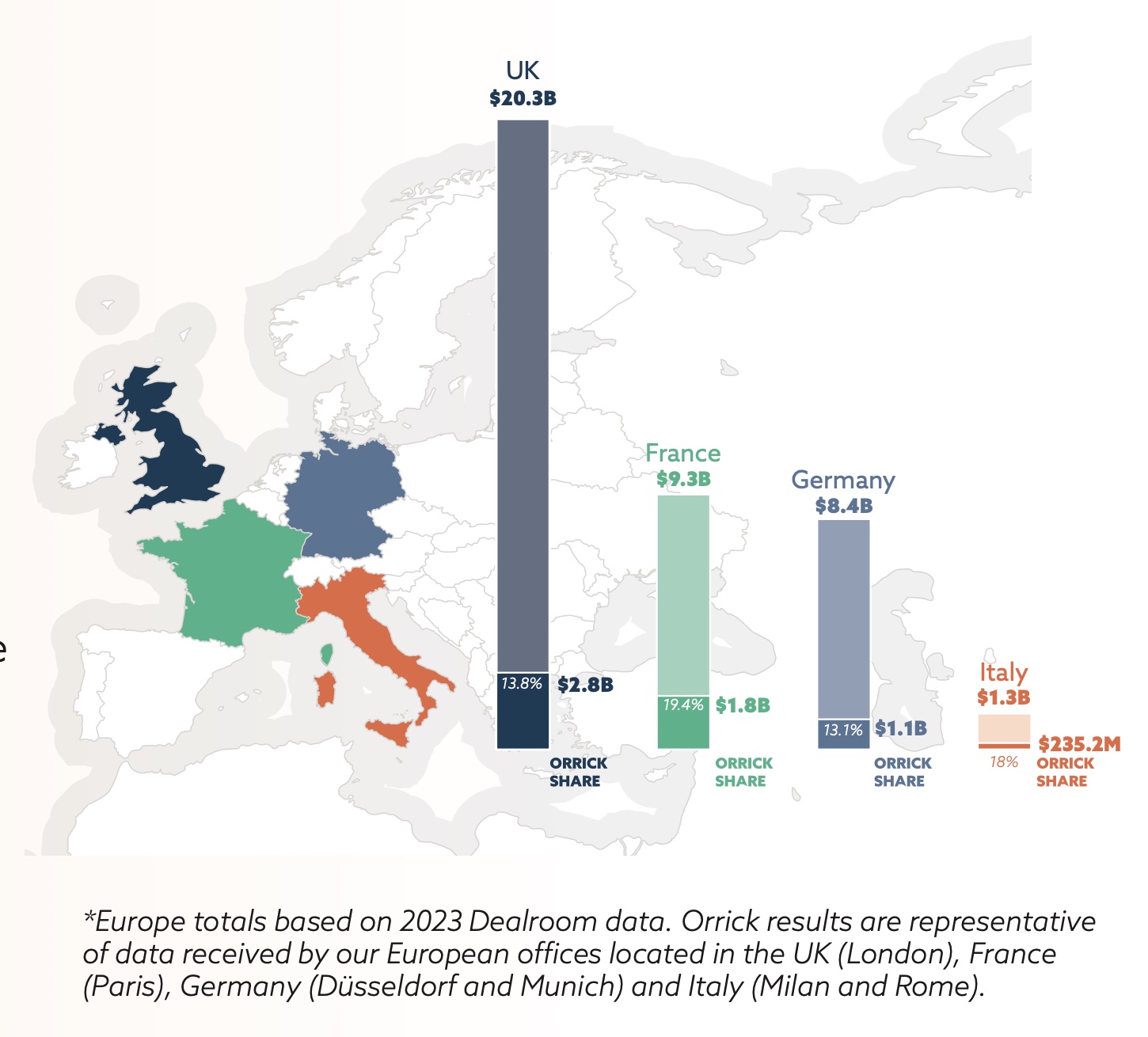

Global law firm Orrick analyzed more than 350 venture capital and growth equity investments completed by its clients in Europe last year.

Total funds raised in Europe were $61.8 billion. 2023 marks a reset and major adjustment in global investment levels. Among the top three regions for global venture capital (Europe, Asia and North America), Europe is the only region that will exceed 2019 levels in 2023.

According to the report, Europe is at “record dry powder levels” and is “producing more new founders than the United States,” but funding remains slow.

Only 11 new unicorns were born in Europe last year, the fewest in a decade, and more and more unicorns are losing their status.

Climate tech overtakes fintech as Europe’s most popular industry

The proportion of total investment in artificial intelligence in Europe soared to 17%, a record high5.

Orrick found that investors, encouraged by the funding slump, are “turning the tables” and exerting greater control over investments, with founders required to provide guarantees in 39% of risky deals.

Late-stage funding is significantly down, deal volume is down, and founders are having to turn to other strategies, such as alternative financing methods, or compete for revenue and profits.

There’s been an “unprecedented surge” in the ability of new investors to enter the tech sector, with convertible debt, SAFE and ASA also seeing an “uptick” as founders look for new lead investors, with convertible financing accounting for 2023 funding rounds 23%.

Investors are generally focused on managing existing portfolios, secondary trading is increasing, and SaaS and AI continue to be popular. Interestingly, the number of fintech investments has declined.

Europe’s 2023 Technology Investment Deals (Orrick)

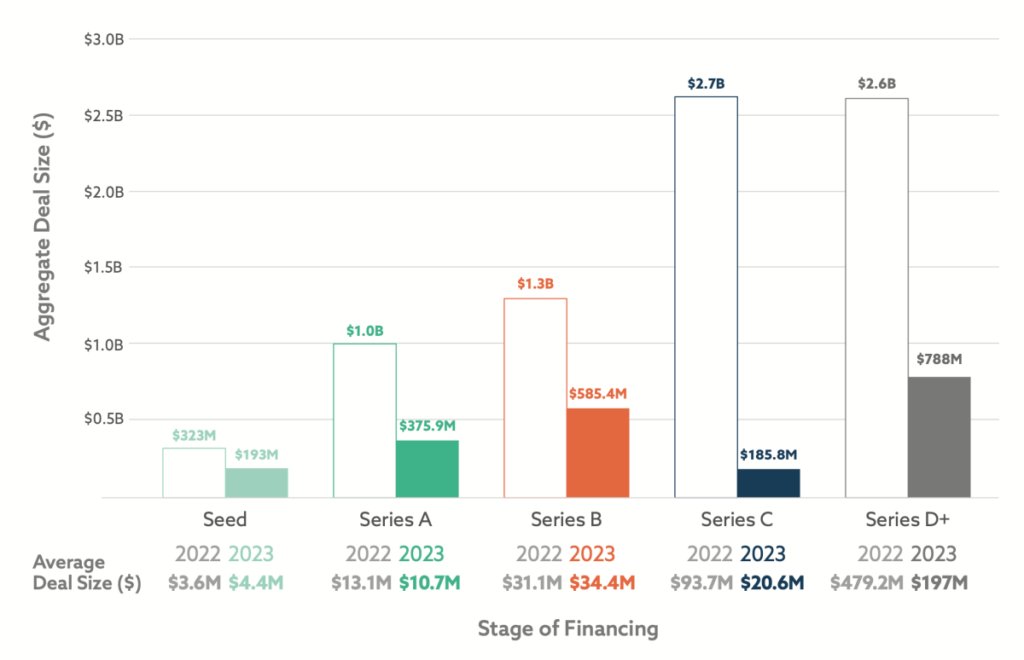

At each stage, deal value declines, with late-stage deals experiencing the most dramatic declines.

Although early-stage investors remain the most active, early-stage deal values fell by 40%.

The number of “large financings” exceeding $100 million declined. However, as the size of ARM’s IPO reached US$55 billion, the IPO landscape showed “signs of life” and merger and acquisition activities also appeared “germinating.”

In the UK, VCs are under pressure to deliver returns, which may lead to increased demand for secondary markets, increased M&A activity and consolidation.

In France, there has been a shift away from “founder-friendly” terminology to more investor-friendly terminology, in stark contrast to the UK, where the opposite is true.

In Germany, growing demand for liquidity from limited partners is expected to “energize the tech M&A pipeline.”