We’re still years away from physical quantum computers hitting the market at any scale and reliability, but don’t give up on deep technology. The market for advanced quantum computer science—the application of quantum principles to manage complex calculations in areas such as finance and artificial intelligence—appears to be gathering pace.

In the latest development, a new startup called MultiverseComputing in San Sebastian, Spain, announced that it raised 25 million euros (approximately US$27 million) in a round of equity financing led by Columbus Venture Partners. The funding, which values the startup at €100 million ($108 million), will be used in two main areas. The startup plans to continue working with startups in verticals such as manufacturing and finance to grow its existing business; it also hopes to make new efforts to work more closely with artificial intelligence companies that build and operate large-scale language models.

In both cases, CEO Enrique Lizaso-Olmos’ mantra is the same: “Optimize.”

In other words, as computing becomes more advanced, it can become more expensive and in some cases too complex to perform consistently. Multiverse’s pitch is that its software platform, Singularity, is designed to be used in a wide range of industries including finance, manufacturing, energy, cybersecurity and defense, and can be used to run and optimize complex modeling and forecasting applications more efficiently.

In the field of artificial intelligence, the focus is more directly on applying platforms to compress large language models, and a new product called CompactifAI focuses on the continuous calculations when building and querying LLMs to remove more noise and speed up the work ( and reliability) when producing results.

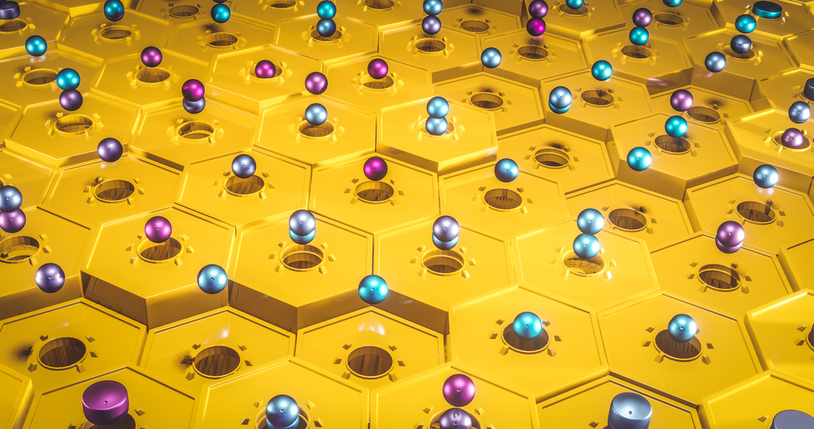

The company claims it can use the software to compress LL.M.s of “quantum-inspired tensor networks” by more than 80% while still producing accurate results. If true, this could have a significant impact on how companies buy and use processors, solving a major bottleneck in the industry to date.

Lizaso-Olmos is a polymath who began his career more than 30 years ago, first qualifying as a doctor, then gaining a second degree in mathematics and then a PhD in computer engineering, to some extent combining these Putting things together, a PhD in biostatistics. He later earned an MBA, he said. Throughout this process, he met like-minded thinkers and friends, some of whom—namely Roman Aurus and Samuel Mugger—were interested in the concept of quantum soft bodies and had already passed research on the subject through rose to prominence through academic work.

“Multiverse started as a WhatsApp group,” he jokes. The year was 2017, and for a thought experiment, some of them thought “it would be fun” to write a scientific paper about what quantum could do in finance.

The paper was eventually accepted at a conference at the University of Toronto, so they agreed. Upon arrival, Lizasso-Olmos saw that the paper was being shared and discussed by people around him, and suddenly it seemed like people could use it as inspiration for entrepreneurial ambitions. That’s when Lizaso-Olmos’ MBA radar kicked in, and he pulled the two friends together for a serious, real-life chat.

That’s how they created the Multiverse Computing with Alfonso Rubio.

The initial exploration of quantum and financial technologies that was the subject of the paper became the company’s first commercial application and first received attention. Since then it has expanded into other areas, with clients including Moody’s Analytics, Bosch, BASF, Iberdrola, Crédit Agricole and BBVA, with Lizaso-Olmos saying both industrial and energy customers like the green aspects of more efficient computing . , today actually the proportion of the company’s business has exceeded that of finance.

In addition to Columbus, previous backer Quantonation Ventures is participating, along with new backers such as the European Innovation Council Fund, Redstone QAI Quantum Fund and Indi Partners.

Javier Garcia said: “Multiverse’s outstanding team will soon apply its unparalleled capabilities to deliver quantum and quantum-inspired software solutions in the life sciences and biotechnology markets, and Columbus Venture Partners will help identify unmet market needs and High-profile industrial partner,” partners at Columbus Venture Partners said in a statement.

While the pitch for the vertical seems to be connecting with customers, it remains to be seen how its ambitions to go higher and target deep tech and artificial intelligence companies themselves might play out for Multiverse. Other competitors in the same space include Alphabet spin-off Sandbox AQ, Quantum Motion and Classiq.