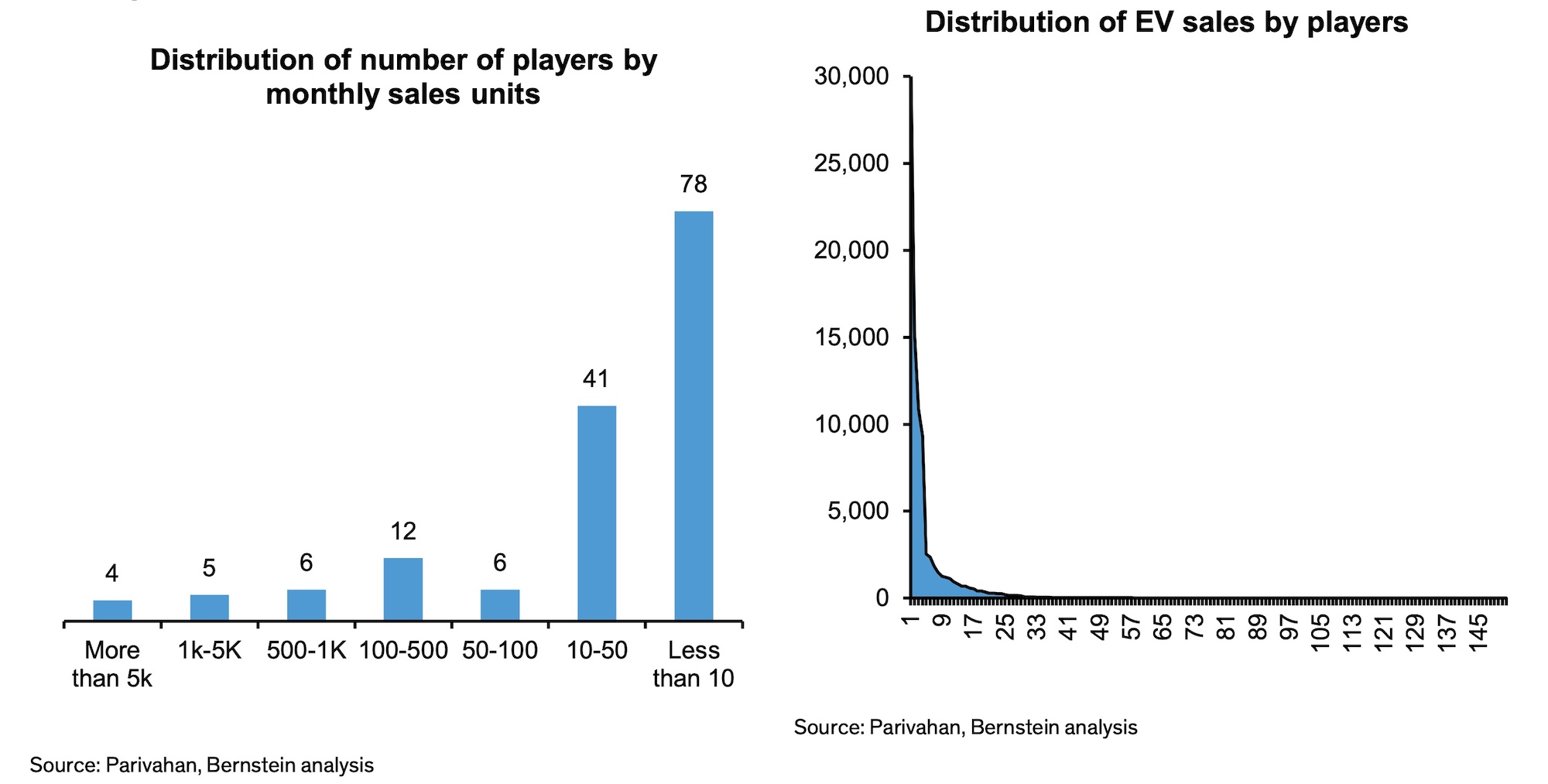

The number of new startups in India’s electric two-wheeler market has surged to more than 150 from 54 in 2021, driven by government incentives to promote cleaner vehicles and cut oil imports, a new analysis shows.

The influx of these people has intensified competition in the segment, which is expected to grow 15-20 times in the next decade, with annual sales reaching 15-20 million vehicles, Bernstein said in a report late Tuesday.

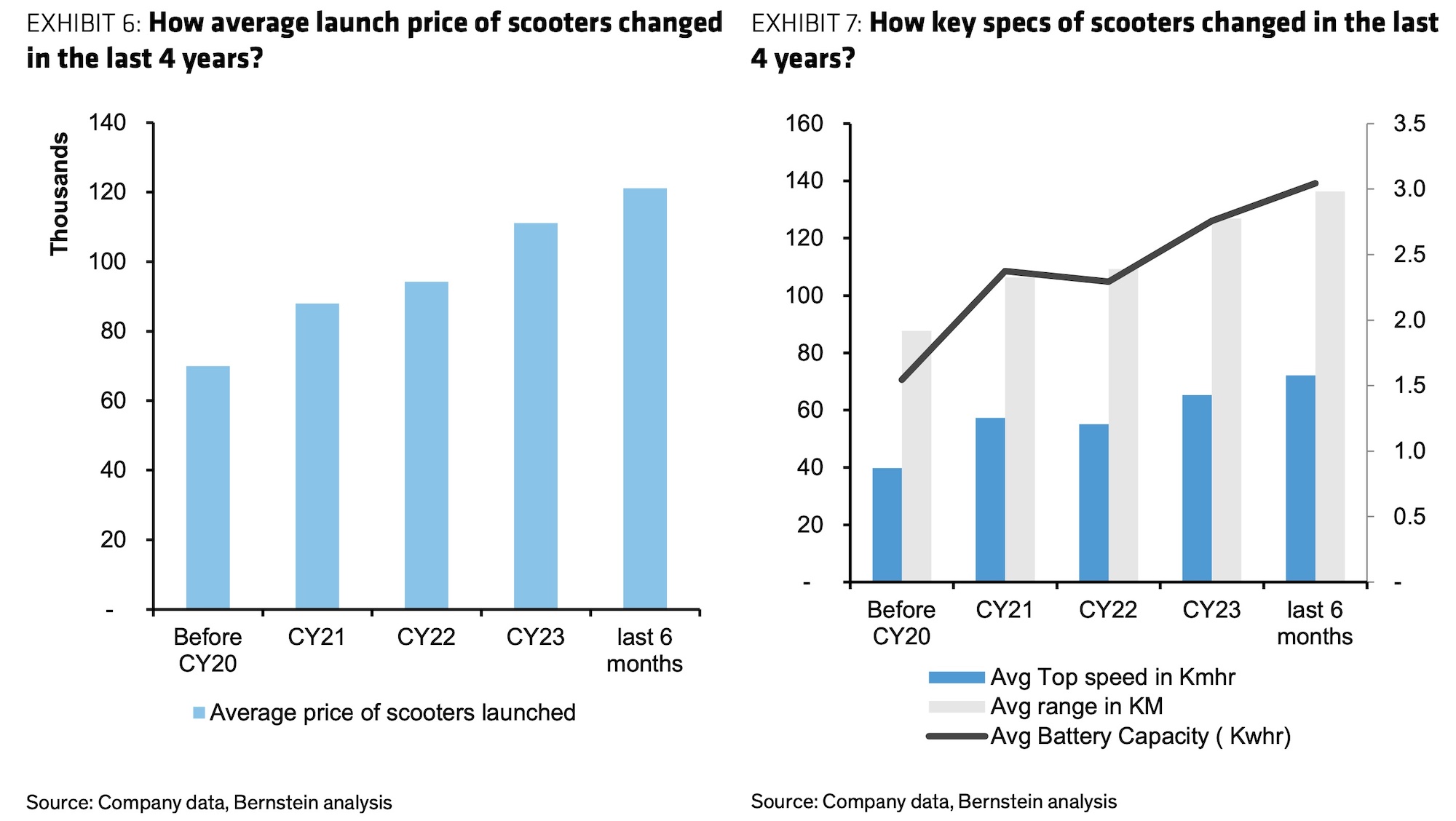

“Most are competing in the mainstream market, with 85% of the 65 models launched last year being such products: high-speed products, rather than speed and range-limited products,” Bernstein analysts wrote. Once a specialty of new startups.” “The average battery capacity of new products will increase from 2.3kWhr in 2022 to 3kWhr.”

India aims to achieve 30% electric vehicle penetration by 2030 and achieve net-zero carbon emissions by 2070. The Indian government has provided incentives under the FAME II scheme, which provides subsidies to buyers and was recently extended to 2024.

Despite the reduction in FAME II subsidies in mid-2023, the number of electric two-wheeler companies increased from 124 in June 2023 to 152 in January 2024, with most of the growth coming from sourcing parts or complete vehicles from abroad. importers,” Bernstein noted.

“Most of them are just kits assembled from China,” said Kunal Khattar, founder of AdvantEdge, a venture capital firm focused on mobility. “It’s not expensive to launch an electric vehicle product. People underestimate brand building and distribution.”

Image credit: Bernstein

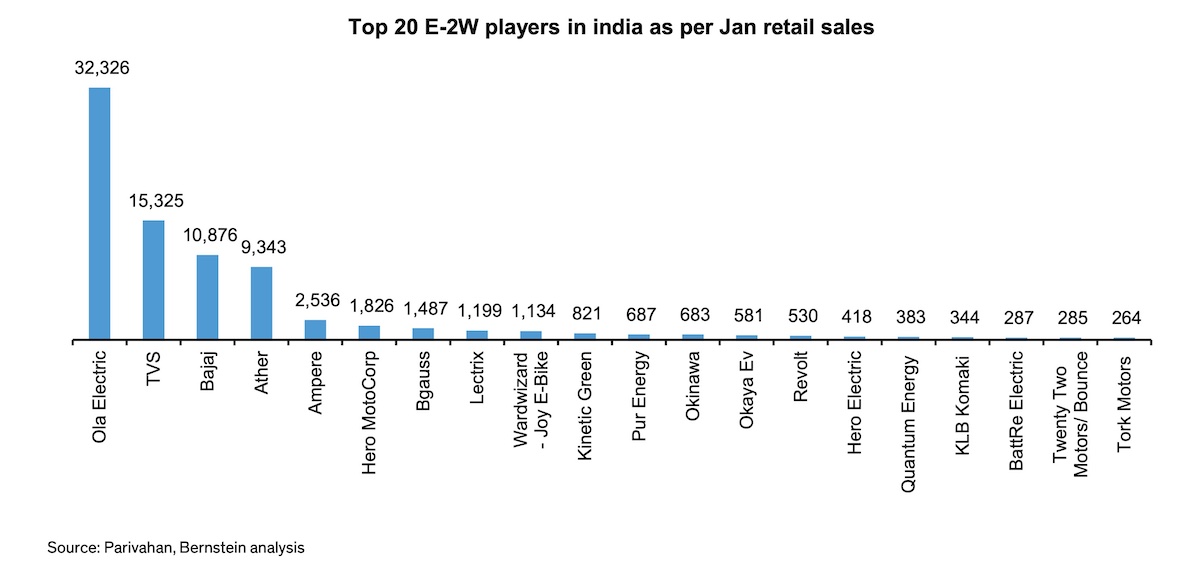

Startups currently occupy 7 of the top 10 spots, including the market leader (Ola Electric; also planning to go public soon) with a 39% share as of January 2024. About 85% of sales are concentrated among the top five players, however.

Bernstein’s analysis found that electric two-wheelers have low barriers to entry and are manufactured using outsourced models and off-the-shelf components. Of the 35 founders they analyzed, only about half had an engineering background.

Image credit: Bernstein

The government is currently moving towards production-linked incentives (PLI) that will benefit domestic manufacturing. Bernstein said most established auto companies have obtained PLI, while only a few startups are eligible, which could provide cost advantages to major established auto companies.

The report believes there is room for at least five new startups to become relevant players alongside established players, but warns that intense competition could lead to lower industry margins and returns in the medium term.

Image credit: Bernstein