Nvidia and Amazon Web Services, Amazon’s lucrative cloud division, has a lot in common. First, their core business was born out of a happy accident. For AWS, it realized it could sell the internal services it had created for itself — storage, computing and memory. For Nvidia, the reality is that GPUs created specifically for gaming purposes are also great for handling AI workloads.

This ultimately led to explosive revenue growth in recent quarters. Nvidia’s revenue has been growing by triple digits, from $7.1 billion in the first quarter of 2024 to $22.1 billion in the fourth quarter of 2024. That’s a pretty staggering trajectory, even though the vast majority of the growth has come from the company’s data center business.

While Amazon has never experienced such a strong growth spurt, it has been a big driver of the e-commerce giant’s revenue, and both companies have experienced first-to-market advantage. Over the years, though, Microsoft and Google have joined the market, forming a triumvirate of cloud providers, and it’s expected that other chipmakers will eventually start to gain meaningful market share, even if the revenue pie continues to grow in the future. several years.

Both companies were clearly in the right place at the right time. With the rise of web applications and mobile devices around 2010, the cloud provided on-demand resources. Enterprises are quickly starting to see the value of moving workloads or building applications in the cloud rather than running their own data centers. Likewise, the takeoff of artificial intelligence over the past decade, and more recently the rise of large language models, has coincided with an explosion in GPU processing of these workloads.

Over the years, AWS has grown into a hugely profitable business, with an operating value now approaching $100 billion, and it would be a very successful company even without Amazon. But while Nvidia is taking off, AWS’s growth has begun to slow. This is somewhat the law of large numbers, and will eventually affect Nvidia as well.

The question is whether Nvidia can sustain this growth and become the long-term revenue giant that AWS is to Amazon. Nvidia does have other businesses if the GPU market starts to tighten, but as this chart shows, those businesses have much smaller revenue streams and are growing much more slowly than the current GPU data center business.

Image Source: Nvidia

short term financial outlook

As shown in the chart above, Nvidia’s revenue growth in recent quarters has been astronomical. That’s set to continue, according to Nvidia and Wall Street analysts.

In its most recent earnings report covering the fourth quarter of fiscal 2024 (the three months ending January 31, 2024), Nvidia told investors that it expects revenue for the current quarter (first quarter of fiscal 2025) to reach $24 billion. Dollar. Compared with the same period last year, Nvidia expects first-quarter growth of approximately 234%.

This is simply not a number we often see among mature public companies. However, given the company’s substantial revenue growth in recent quarters, its growth rate is expected to decline. Judging from the 22% revenue growth from the third quarter to the fourth quarter of the recently ended fiscal year, Nvidia expects a more modest revenue growth rate of 8.6 from the last quarter of fiscal 2024 to the first quarter of fiscal 2025. %. Compared to the same period last year, rather than just looking back three months, Nvidia’s growth rate in the current period is still incredible. But there will be other growth slowdowns ahead.

For example, analysts expect Nvidia to generate $110.5 billion in revenue this fiscal year, up more than 81% from the same period last year. That’s well below the 126% increase in the recently ended fiscal 2024.

To this we ask: so what? Nvidia’s annual revenue is expected to continue to top the $100 billion mark for at least the next few quarters, which is impressive for a company that had total revenue of just $7.19 billion a year ago.

In short, both analysts and Nvidia believe the company is poised for tremendous growth ahead, even if some of its eye-popping revenue growth numbers are set to slow this year. It’s unclear what will happen on a slightly longer time scale.

Forward momentum

Even as more competition from AMD, Intel, and other chipmakers begins to emerge, artificial intelligence seems likely to be a gift that continues to be given to Nvidia for years to come. Like AWS, Nvidia will eventually face tougher competition, but it currently controls so much market share that it can afford to give up some.

Looking purely at the chip level (rather than the circuit board or other adjacent layers), IDC shows that Nvidia has firm control over:

Image Source: international information center

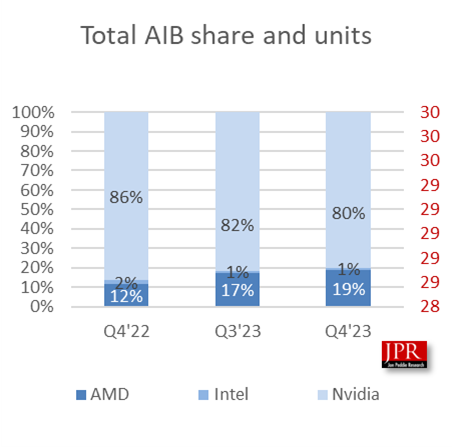

If you look at market share data from Jon Peddie Research (JPR), a firm that tracks the GPU market, and look at what’s happening at the motherboard level, while Nvidia still dominates, AMD is getting stronger:

Image Source: Jon Peddie Research

JPR analyst C Robert Dow said some of the fluctuations were related to the timing of new product launches. “AMD’s gains depend on market cycles (when new cards are launched) and inventory levels, but Nvidia has been dominant for years and that will continue,” Dow told TechCrunch.

Shane Rau, an IDC analyst who tracks the silicon market, also expects this dominance to continue even if trends change. “There are trends and there are counter-trends. The market that Nvidia participates in is large and growing, and growth will continue, at least for the next five years,” Law said.

Part of the reason is that Nvidia sells more than just the chips themselves. “They will sell you the motherboard, system, software, services and time on one of their own supercomputers. So these are huge and growing markets, and Nvidia is interested in these markets,” he said.

But not everyone thinks Nvidia is an unstoppable force. Longtime cloud consultant and author David Linthicum says you don’t always need a GPU, and companies are starting to realize this. “They said they needed GPUs. I looked at it and did some rough math and they didn’t need them. CPUs are totally fine,” he said.

When that happens, he believes Nvidia’s growth will start to slow down and competition will weaken its position in the market. “I think we’re going to see Nvidia become a weaker player in the next few years. We’re going to see that because there are so many alternatives being built out there.”

Rau said other vendors will also benefit as companies leverage Nvidia products to expand artificial intelligence use cases. “I think in the future you will see a growing market, which will create tailwinds for Nvidia. But then other companies will follow and benefit particularly from artificial intelligence.”

It’s also possible that some disruptive forces will come into play, which would be a positive outcome and prevent one company from becoming too dominant. “You almost expect disruption to happen because that’s how markets and capitalism work best, right? Someone leads the way, other vendors follow, and the market keeps growing. You get established players who eventually will be disrupted by better ways to do the same thing in their market or in adjacent markets that are entering their market,” Law said.

In fact, we’re starting to see this happen with Amazon as Microsoft makes progress through its relationship with OpenAI and Amazon is forced to play catch-up in artificial intelligence. Whatever happens to Nvidia in the long run, it’s now firmly in the driver’s seat, making tons of money, dominating a growing market, and pretty much everything is going right. But that doesn’t mean that will always be the case, or that there won’t be more competitive pressures in the future.